The federal government wants to incentivize homeowners to invest in solar products so new and existing homes qualify for the tax credits as well as primary residences and second homes.

Federal tax credit for solar hot water heater.

Water heaters account for 12 of the energy consumed in your home.

A nonrefundable tax credit allows taxpayers to lower their tax liability to zero but not below zero.

Federal income tax credits and other incentives for energy efficiency.

You can learn more about the details of the federal tax credit.

150 for any qualified natural gas propane or oil furnace or hot water boiler.

Uniform energy factor uef 0 82.

300 requirements uniform energy factor uef 0 82 or a thermal efficiency of at least 90.

Most energy star certified water heaters meet the requirements of this tax credit.

All energy star certified solar water heaters qualify for the tax credit.

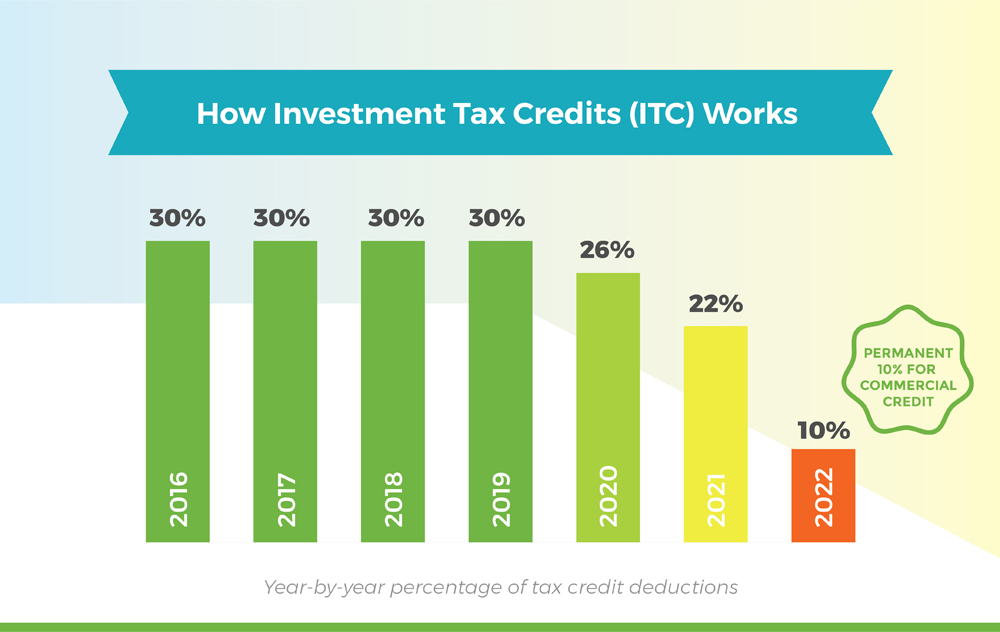

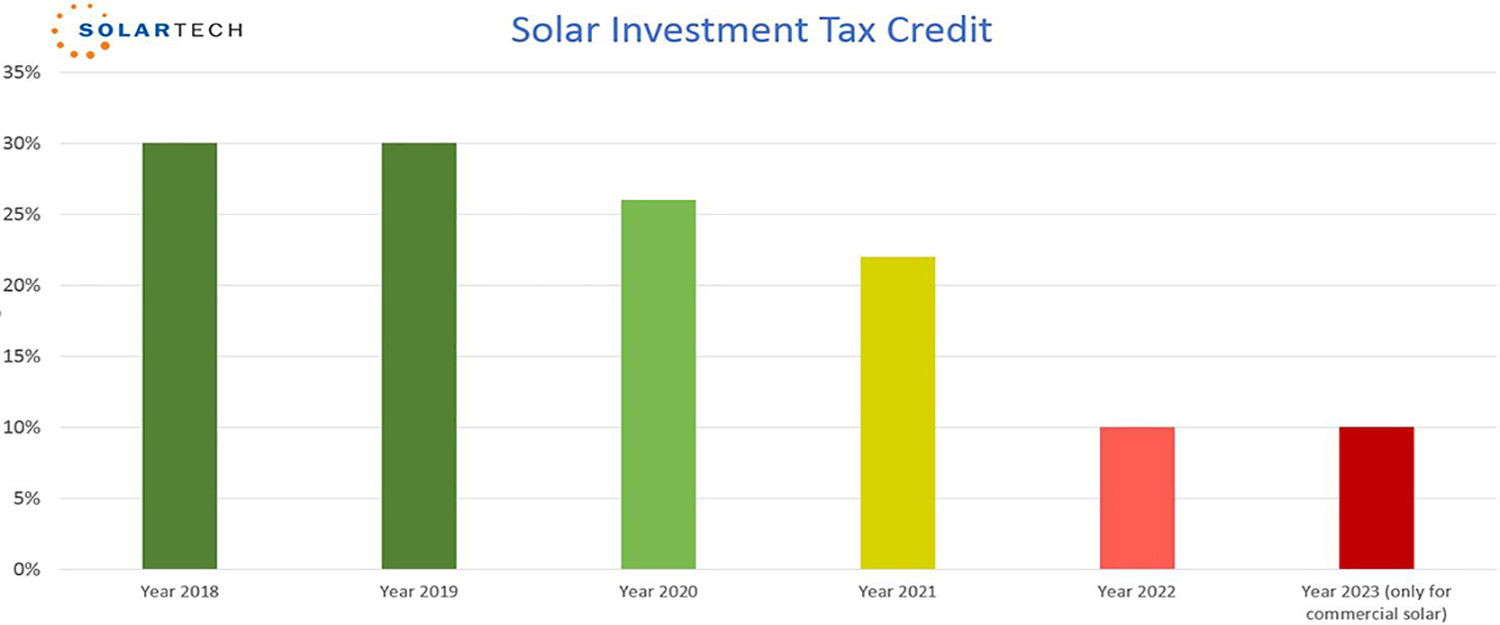

12 31 2017 through 12 31 2020.

The credit is not available for expenses for swimming pools or hot tubs.

Residential gas oil propane water heater.

Do solar hot water repairs qualify for tax credits.

Residential electric heat.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

The water must be used in the dwelling.

Use irs form 5695 to claim this tax credit.

Other common questions about solar hot water heater tax credits.

The tax credit is for 50.

However for the tax years 2017 through 2021 only qualifying solar systems are eligible for water heater tax credits on your federal tax returns.

They are considered maintenance expenses rather than home improvement expenses and therefore are not eligible.

Is a solar water heater installed for a swimming pool or hot tub eligible for a tax credit.

Electric heat pump water heater.

So if you have a second home out of state that will work as well for the federal tax credit.

Before 2016 different types of water heaters were eligible for the energy efficiency tax credits.

The tax credit is for 300.

The residential energy property credit is nonrefundable.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

Residential water heaters or commercial water heaters and select yes for tax credit eligible under advanced search.